How Credit Unions Can Fix Their POA Workflow

Credit unions are built on trust, and today, that trust is tested not just by fraud, but by friction.

Power of Attorney (POA) forms are critical for serving members through life’s milestones: managing a spouse’s finances, helping aging parents, or stepping in during deployment or illness. But for many credit unions, the POA process is still manual: paper-based, error-prone, and slow.

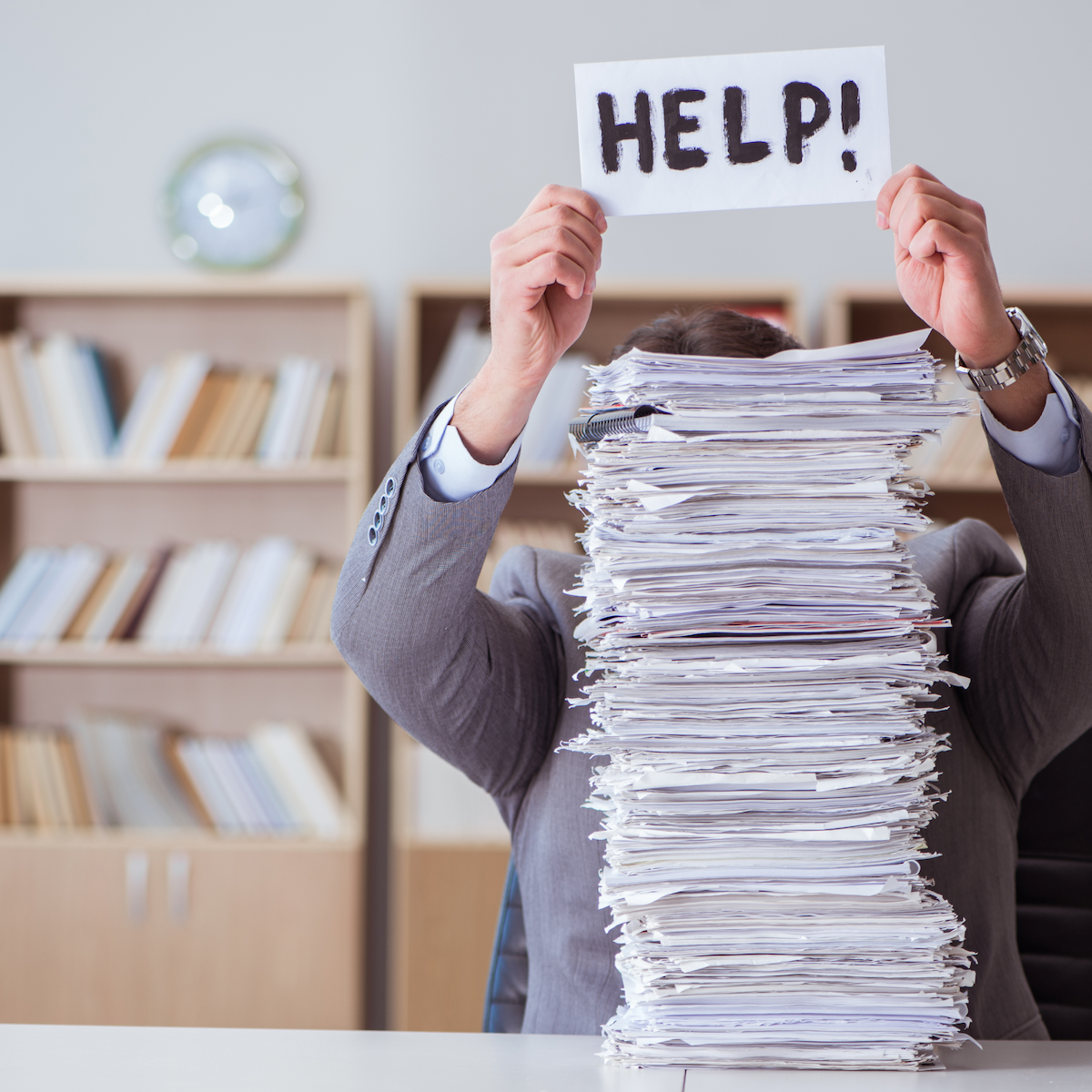

That creates a bottleneck. Members are left waiting. Staff are overwhelmed. And the cost isn’t just time. It’s trust, dropped applications, and rising operational burden. Yes, fraud is a risk with POAs. But the bigger issue? Inefficiency. And fixing it doesn’t just reduce that fraud risk - it improves the entire member experience.

Here’s why manual POA workflows are holding credit unions back, and how leading institutions are digitizing the process to serve members faster and more securely.

Why POAs Are a Process Problem

POAs touch some of the most sensitive, high-stakes moments in a member’s financial life. But the way they’re handled today often feels like a step back in time:

- Paper forms must be mailed, scanned, or hand-delivered

- Staff must visually review signatures and dates

- Notary appointments require scheduling and follow-up

- Errors lead to rework, delays, and frustrated members

It’s a process built for a branch-first world - and in 2025, that’s no longer enough.

What Manual POAs Cost Your Credit Union

POAs may be infrequent, but when they go wrong, the downstream impact is significant.

Slower Service

Members can’t wait days for a POA to be signed, notarized, and verified—especially when they’re authorizing urgent action on a loan, account, or estate.

Rework and Resource Strain

Incomplete forms, missing signatures, and notary mistakes require staff to follow up, resubmit, and redo. That wastes time and energy your team doesn’t have.

Member Drop-Off

When the POA process gets clunky, some members simply stop. Whether it’s a loan that doesn’t fund or a caregiver who gives up on getting access, your institution pays the price.

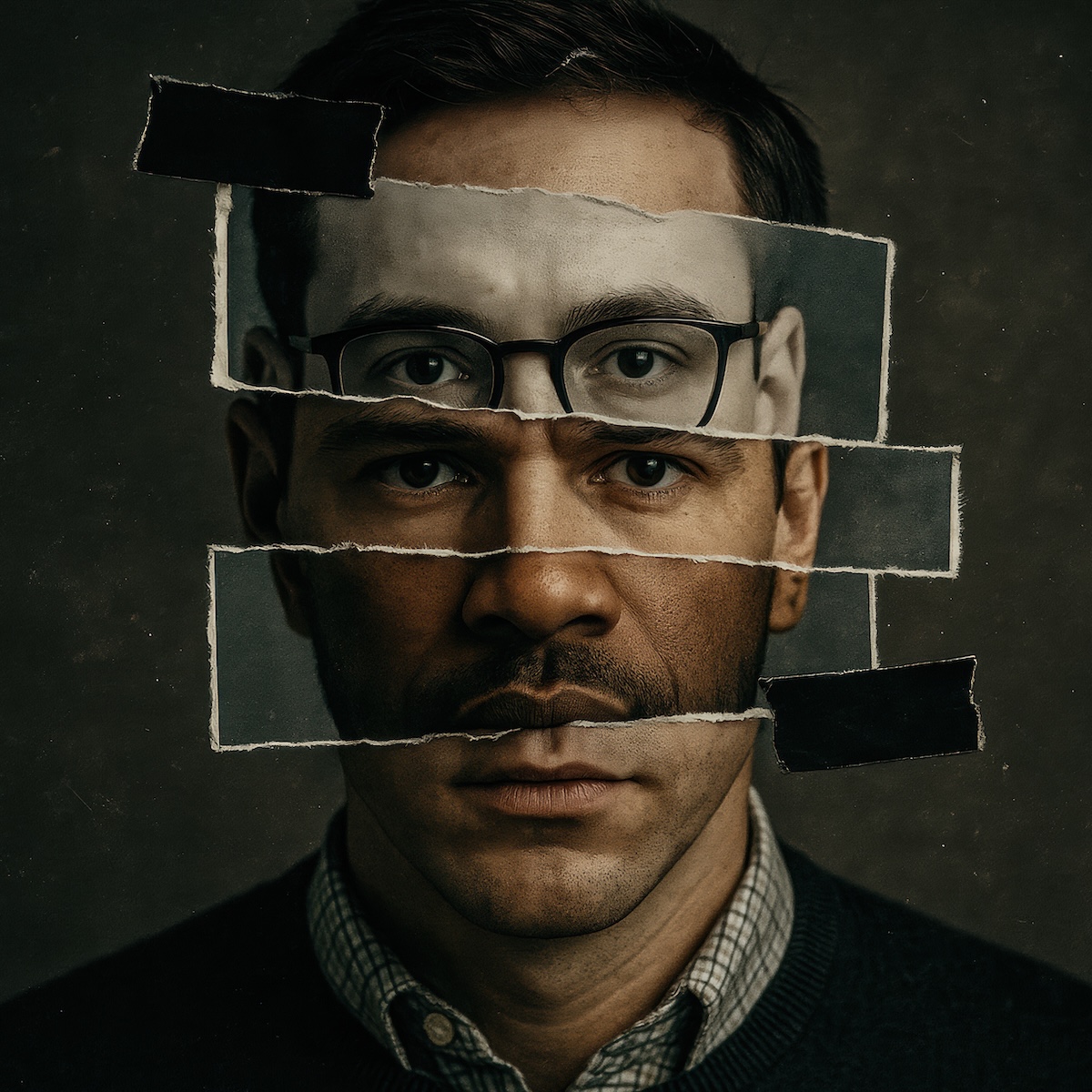

Exposure to Risk

Manual POAs also leave gaps for fraud: forged signatures, outdated authority, or coercion. When your review process relies on visual checks and trust alone, it’s easy to miss what matters.

The Case for Digitizing POAs

Digitizing your POA process isn’t about replacing people; it’s about empowering them. It’s about turning a manual, error-prone task into a secure, guided workflow that reduces review time, eliminates confusion, and gives members the service they expect.

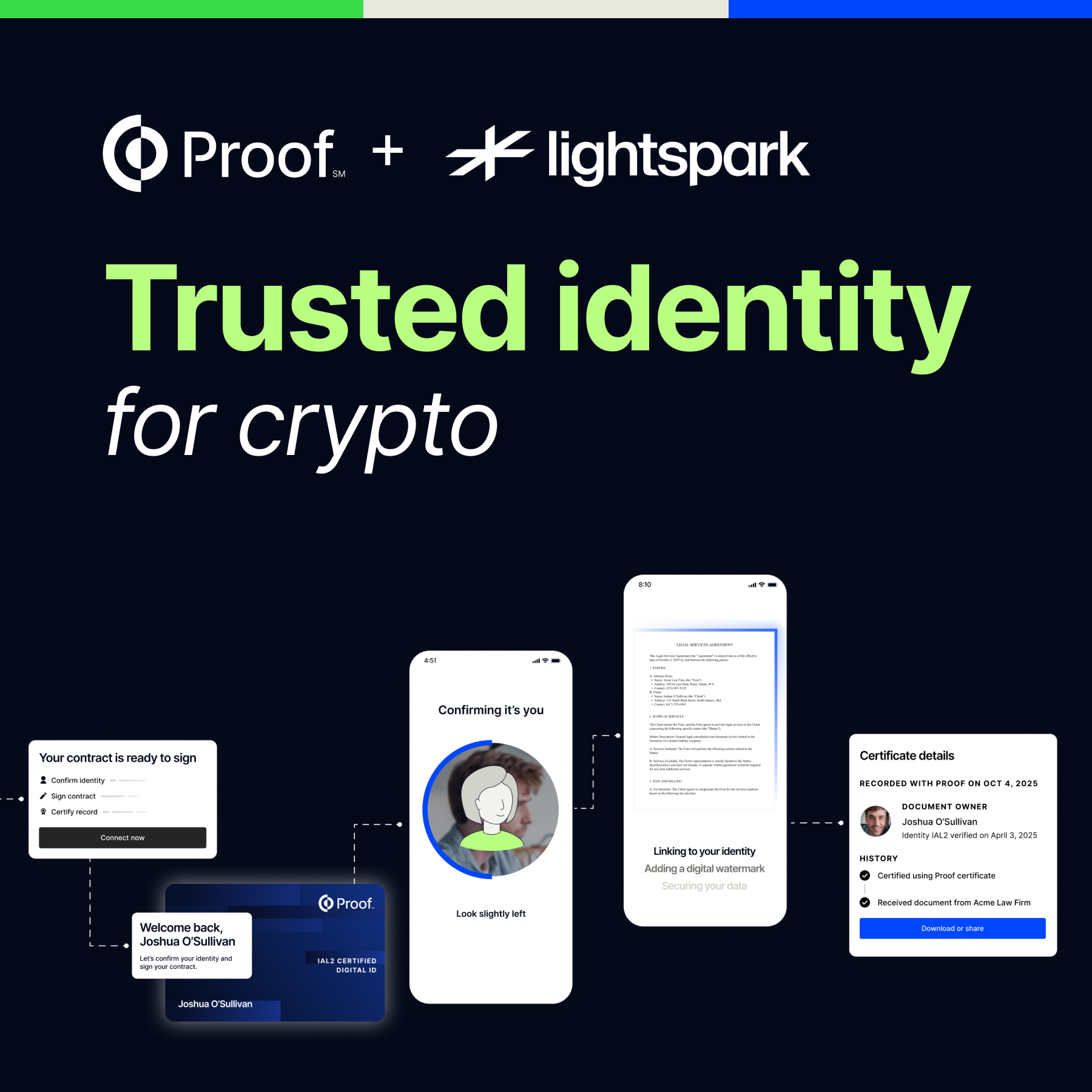

Streamline POA Workflows from End to End

From initiation to notarization, every step of the POA process happens in one digital experience. No mail delays. No printing. No app required.

- Members can complete POAs in under 6 minutes, often from their phone

- Staff can monitor progress, access documents, and route them internally without rework

- All transactions are automatically archived and audit-ready

Reduce Errors with Built-In Compliance

Proof embeds state-specific notary requirements, identity verification, and document validation into the process itself. That means:

- No missed fields or invalid signatures

- No guessing about what’s legally sufficient

- No stress when auditors come calling

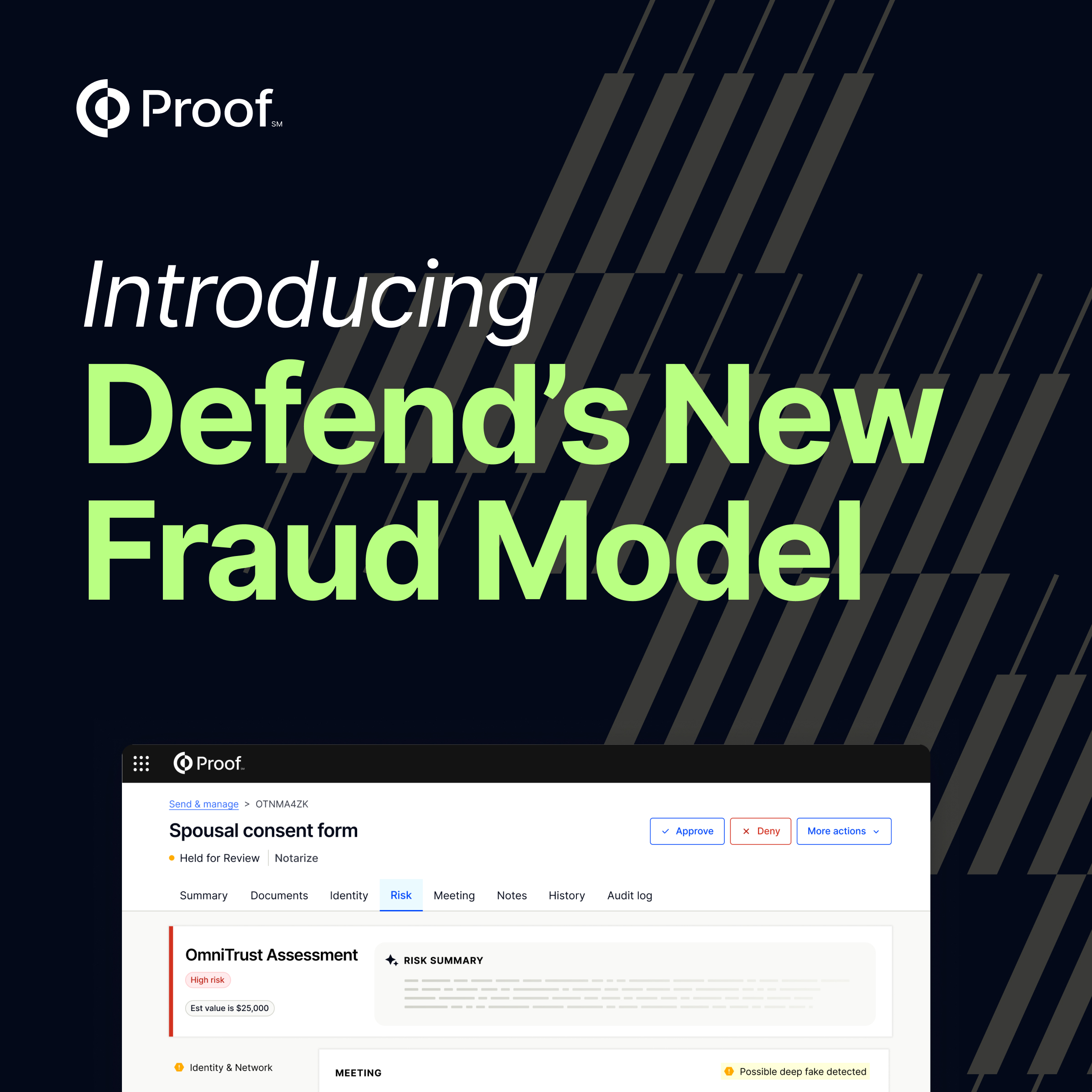

Verify Signers Before Problems Arise

Every signer is authenticated through:

- Government ID analysis

- Biometric facial recognition

- Knowledge-based authentication (KBA)

- SMS verification and real-time fraud scoring

These protections aren’t just about preventing fraud - they’re about giving your staff confidence that the paperwork is real, complete, and defensible.

Offer Members Convenience and Confidence

Today’s members expect a digital-first experience, even for complex paperwork. Proof meets them where they are:

- Mobile-optimized workflows

- 24/7 access to trusted online notaries

- No need to visit a branch or hunt down a notary

Whether a caregiver is accessing funds on a parent’s behalf or a military spouse is handling a HELOC, the process is fast, secure, and easy to follow.

From Friction to Confidence

Manual POAs don’t just slow you down, they wear your team out. And when members are forced to jump through hoops, it chips away at the very thing that sets credit unions apart: service.

With Proof, you’re not just preventing fraud, you’re preventing frustration.

You’re not just staying compliant, you’re delivering peace of mind.

You’re not just digitizing a document, you’re creating a better way to serve.

Your members deserve service that moves at the speed of their lives. And your team deserves tools that make that possible, without increasing overhead or legal risk. With Proof, you can transform the POA workflow from a risk point into a relationship builder. And we’ll help you get there in days, not months.

Join the Conversation

Want to see how other credit unions are turning POAs from a hassle into a high-impact member experience?

Watch our on-demand webinar with industry experts and a real-time demo of digital POAs in action. You’ll learn how to serve members faster, reduce internal workload, and eliminate paperwork for good.

.png)

.jpg)