Identity and notarization for retirement

Money-out transactions often stall due to identity friction, paperwork, and in-person steps. Proof unifies identity, consent, and documentation so participants can complete requests quickly and securely.

Where Proof fits into retirement workflows

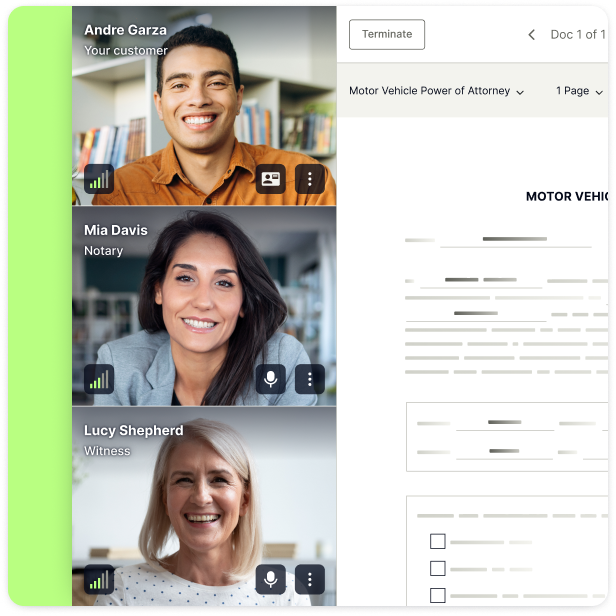

Notarization

Withdrawals

Spousal consent

Identity verification

Account changes

Account recovery

Results from a leading 401(k) recordkeeper

300k+

annual documents notarized

<1 sec

to connect with a notary

<6 min

notarization time, start to finish

4.7 / 5

average satisfaction score

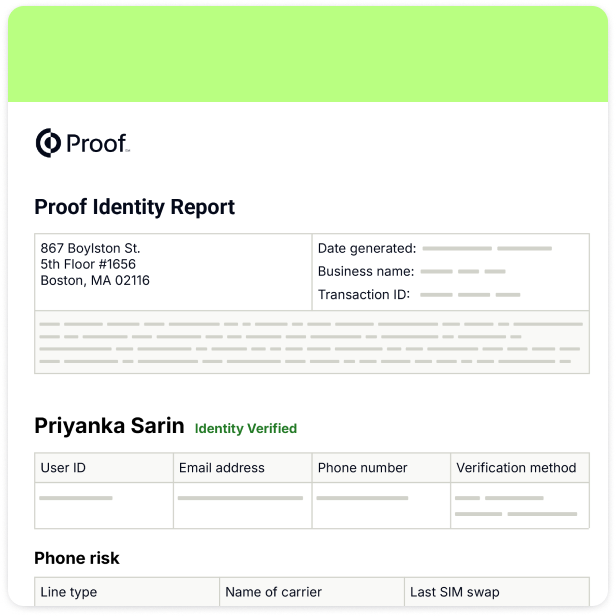

Verified identity, clear consent, and build accurate records that fiduciaries can rely on.

Why recordkeepers choose Proof

Lower NIGO (Not in good order)

Guided digital workflows reduce errors, missing signatures, and incomplete forms, so more retirement transactions can be processed on the first pass.

Fewer manual reviews

Identity, consent, and documentation are captured in one place and kept digital, helping teams spend less time chasing paperwork and resolving avoidable issues.

Reduced account takeover risk

High-assurance identity verification and tamper-proof records protect sensitive retirement actions and safeguard participant accounts.

Consistent experiences

Participants and recordkeepers alike move through a clear, digital flow for withdrawals and account changes, raising complete rates and reducing support needs.

Put Proof to the test

Frequently Asked Questions

What retirement workflows does Proof support?

Proof supports withdrawals, rollovers, spousal consent, beneficiary updates, account changes, account recovery, and POA. Each workflow includes identity verification, digital signatures and/or notarization, and audit-ready documentation.

How does pricing work for retirement workflows?

Proof supports both company-paid and signer-paid models, depending on how your organization prefers to handle transaction costs. We can help you determine the structure that best fits your operational and participant experience needs.

How can we initiate identity or notarization for withdrawals or account changes quickly?

EasyLinks let teams initiate identity verification or notarization using secure, preconfigured links—no engineering work required. They’re a fast way to start modernizing withdrawal, rollover, and account-change workflows.

How does Proof support ERISA requirements?

Proof verifies identity, captures required consent or notarization, and generates detailed records that fiduciaries can retain and reference for compliance and audit needs.

Can Proof help reduce NIGO and rework?

Yes. Guided digital flows help reduce common errors, missing signatures, and incomplete fields so more transactions can be processed correctly the first time.

Is Proof compliant with state and federal requirements?

Yes. Proof meets or exceeds all state and local requirements for remote online notarization (RON), identity verification, and electronic signatures, and is accepted in all 50 states.

How long does it take to implement Proof?

Most teams are up and running in under a week. We don’t require any rip-and-replace; Proof fits into your existing systems and processes with minimal lift