Why Manual POAs Are Slowing Auto Refinancing Down…and How to Fix It

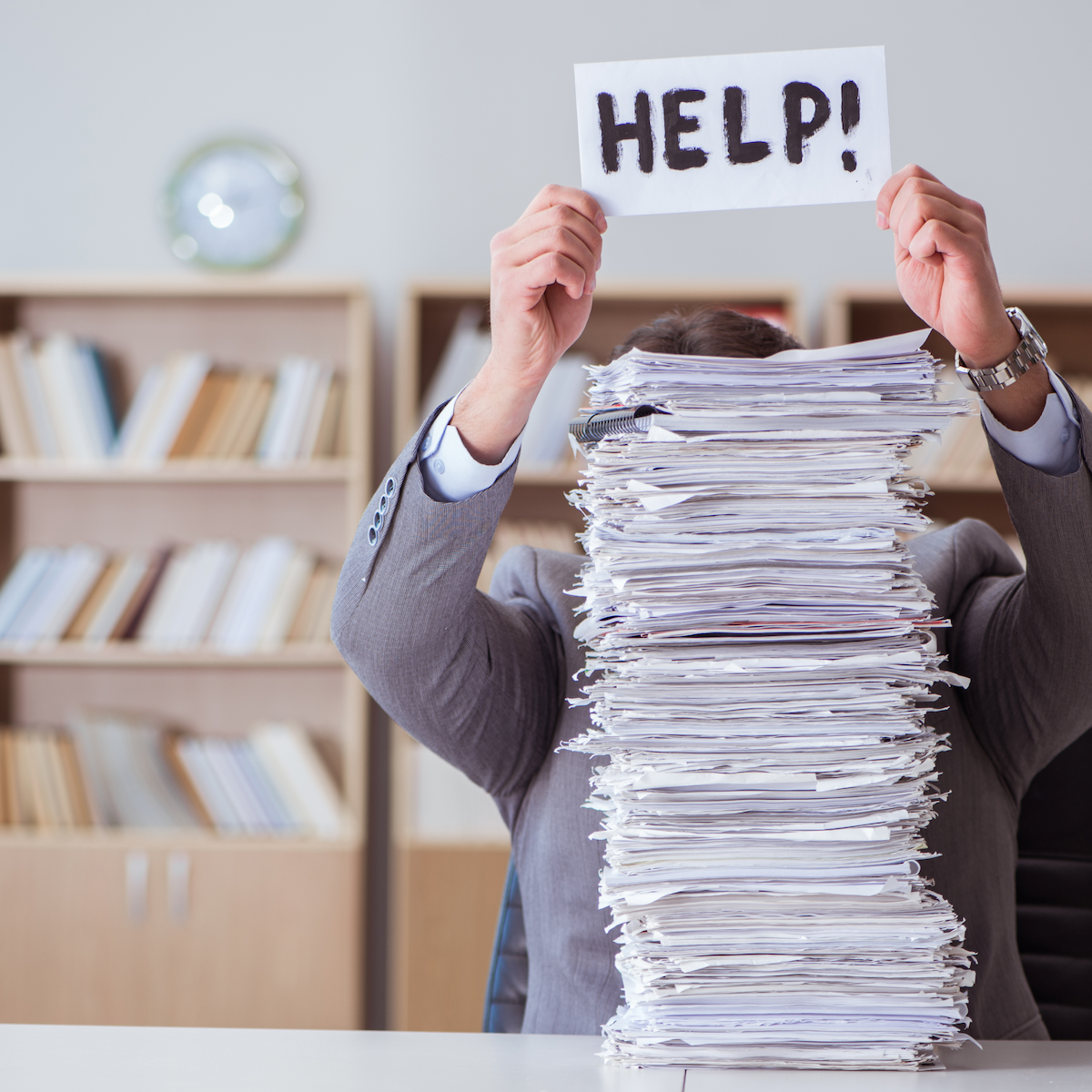

In auto refinancing, time is money - and paperwork is the enemy.

Power of Attorney (POA) forms are essential for processing title transfers, odometer disclosures, and lien releases. But in many auto workflows, they’re still manual: printed, signed in-person, notarized at a third-party location, and routed back via FedEx.

That kind of process might have worked in the past…but today, it’s a bottleneck.

Manual POAs delay funding, frustrate borrowers, and eat up staff time. They’re also notoriously error-prone and wide open to fraud. The longer they stay offline, the more deals (and trust) you risk losing.

The good news? POA inefficiency is entirely fixable. And modern platforms like Proof can digitize the process without sacrificing compliance, security, or borrower experience. Here’s a look at where manual POAs are breaking down - and how leading auto lenders are turning them into a competitive advantage.

The Real Problem With Paper POAs

Let’s be clear: POAs aren’t the issue. Manual POAs are.

When you rely on paper documents and in-person notarization, every step becomes a point of friction:

- Borrowers wait on notary appointments or document mail-backs

- Teams chase down signatures, scan forms, and re-key information

- Errors pile up, triggering rework, delays, and funding gaps

- Fraud slips through, with no audit trail or signer verification

What should take minutes often takes days. And the operational cost of that delay adds up fast - especially at scale.

Common POA Headaches We Hear About From Auto Lenders

Missed Deadlines and Delayed Funding

Manual POAs slow down title work and delay lien releases. That stalls funding and forces your team into firefighting mode.

Incomplete or Incorrect Paperwork

Missing signatures, incorrect forms, and lost documents can derail an otherwise clean deal. And fixing those errors takes time your team doesn’t have.

High Operational Overhead

Mailing, printing, scanning, and overnighting documents isn’t just slow; it’s expensive. It also pulls your staff away from high-value tasks.

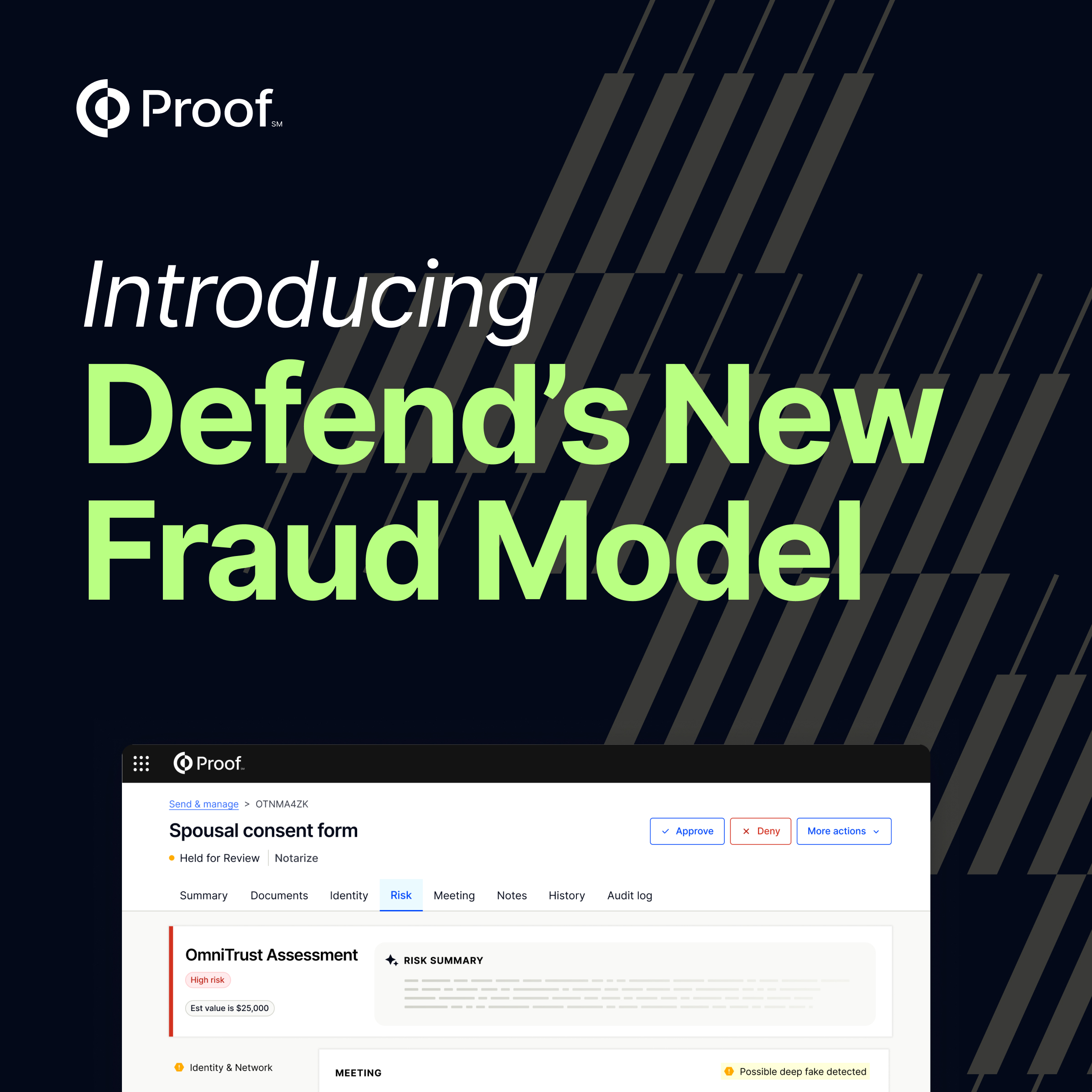

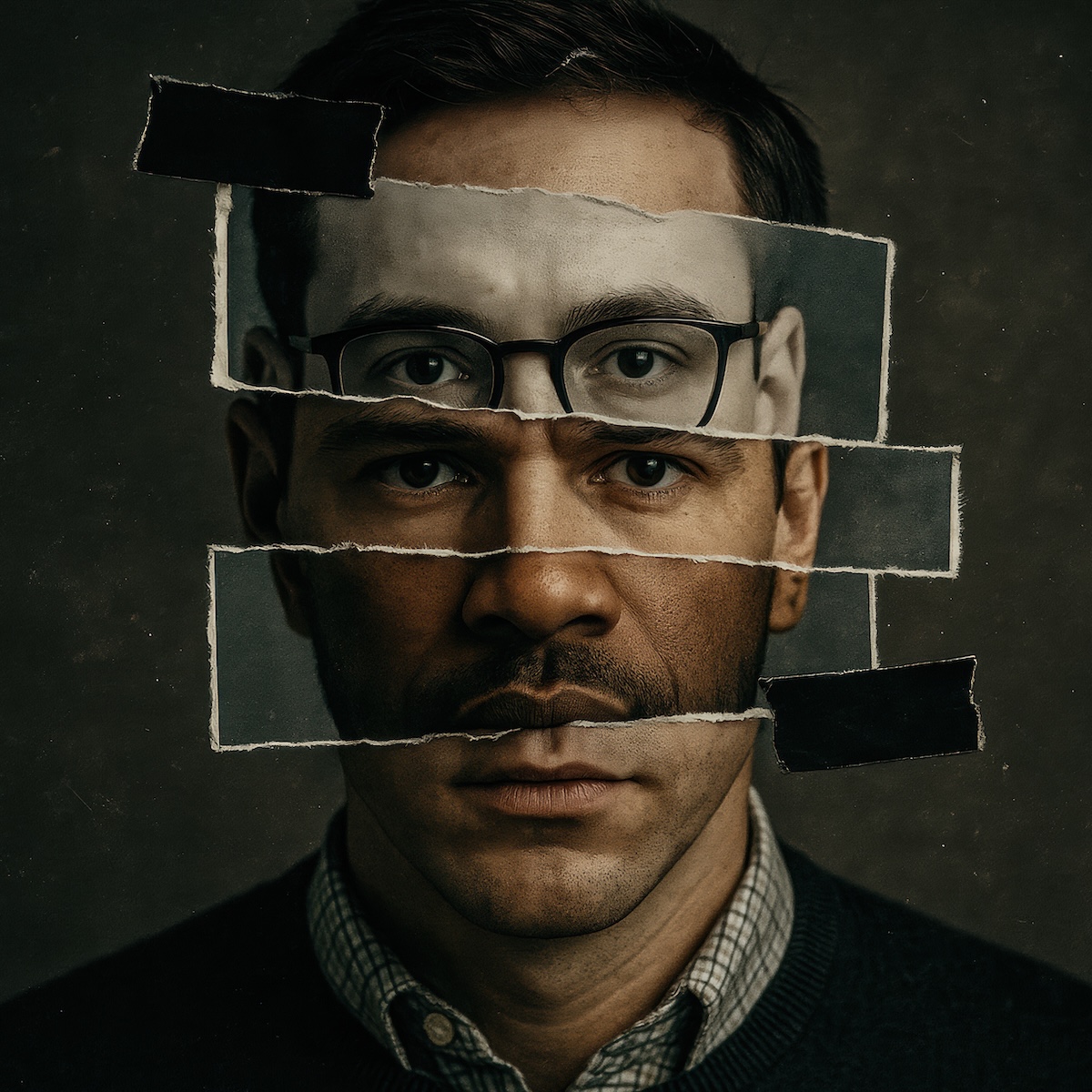

Fraud and Compliance Gaps

Without proper identity verification or audit logs, paper POAs create risk. Forged signatures or unauthorized transfers can lead to title disputes, regulatory exposure, and legal consequences.

Why Digitizing POAs Solves More Than One Problem

Digitizing your POA workflow isn’t just about modernizing for the sake of it. It’s about eliminating waste, reducing errors, and building trust into every transaction. Here’s how Proof helps auto lenders do exactly that:

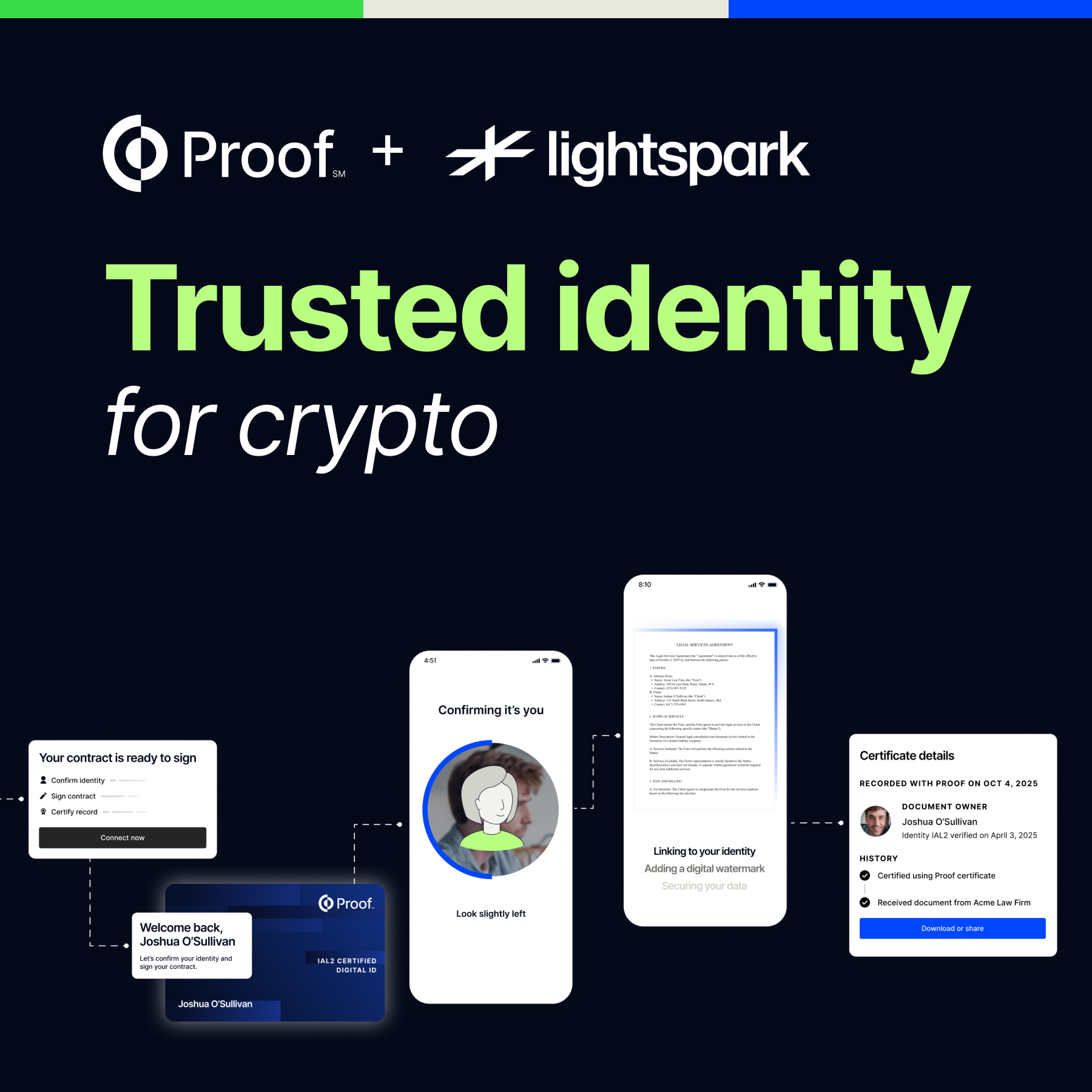

End-to-End Workflow Automation

With Proof, POAs can be initiated, signed, and notarized in one seamless digital flow - no apps, no printers, no shipping delays.

- 77% of POAs completed within 24 hours

- Up to 25% fewer document errors

- Borrowers complete forms in under 6 minutes, often on their phones

Built-In Identity Verification

Every signer is verified before the POA is finalized using multiple layers of protection:

- Government-issued ID scanning

- Biometric facial recognition

- Knowledge-based authentication (KBA)

- SMS-based confirmation

This reduces the risk of forgery or impersonation without adding friction.

Secure Online Notarization

Proof’s remote online notarization (RON) replaces scheduling chaos with 24/7 access to a vetted notary network. It’s faster for borrowers and fully auditable for your compliance team.

Every notarization includes:

- Tamper-proof seals

- Time-stamped audit trails

- Notary session video recordings

Integrations That Don’t Break Your Process

Proof connects directly with your DMS, CRM, or document workflow tools. There’s no “rip and replace”, just a smoother, more efficient POA experience built around how your team already works.

The Results: Faster Closings, Happier Borrowers, Less Rework

Auto lenders using Proof report:

- Faster loan funding

- Higher borrower satisfaction

- Reduced staff time spent chasing forms

- Lower exposure to fraud and compliance risk

Instead of being a choke point, POAs become a proof point, showing borrowers and partners that your team runs a secure, streamlined operation.

Manual POAs were built for a different era. Today’s borrowers expect fast, digital service. Your team needs process clarity. And fraudsters? They’re counting on you to stick with the status quo.

It’s time to close the gap.

Proof helps auto lenders modernize POAs without adding complexity or risk. And we’ll guide you through every step of setup, so you’re up and running in days, not months.

Join the Conversation

Want to see how other lenders are transforming POA workflows from a pain point into a performance boost?

Join us for a live webinar with industry experts and a live demo of digital POAs in action. You’ll learn how to close faster, protect your borrowers, and leave paperwork in the dust.

👉 Register here: https://hubs.la/Q03zGVj50

.png)

.jpg)