Lock in trust with identity verification for every customer

Lock in trust with identity verification for every customer

1. Request identity verification and eSignature from your customer

Email a document from the Proof platform by triggering a request through the API or creating manually through the UI to start the identity verification process.

2. Your customer receives an SMS or email to initiate the verification process

They will use either mobile web or their desktop to complete their verification - whatever is most convenient for them.

3. Your customer verifies their identity

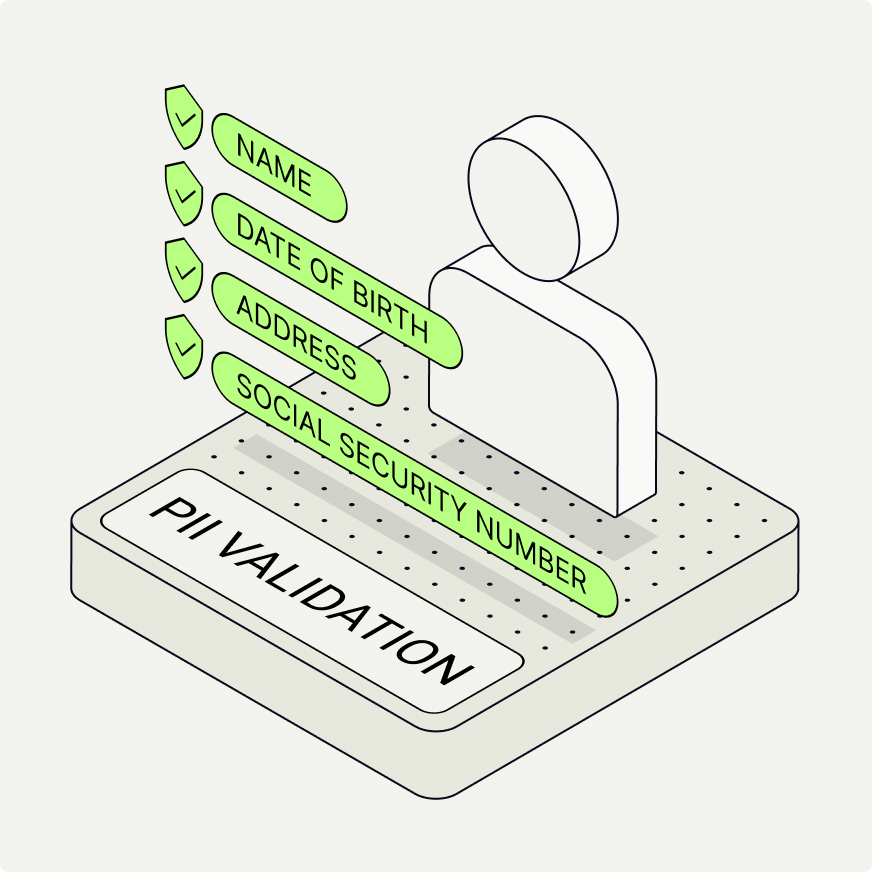

Businesses can customize the level of verification for each transaction. Your customer will answer a few challenge questions based on the personal information provided (knowledge-based authentication), take photos of their ID (credential analysis), and we'll confirm their identity in seconds. You could also choose to verify a customer to the IAL2 standard, which is a higher level of identity verification.

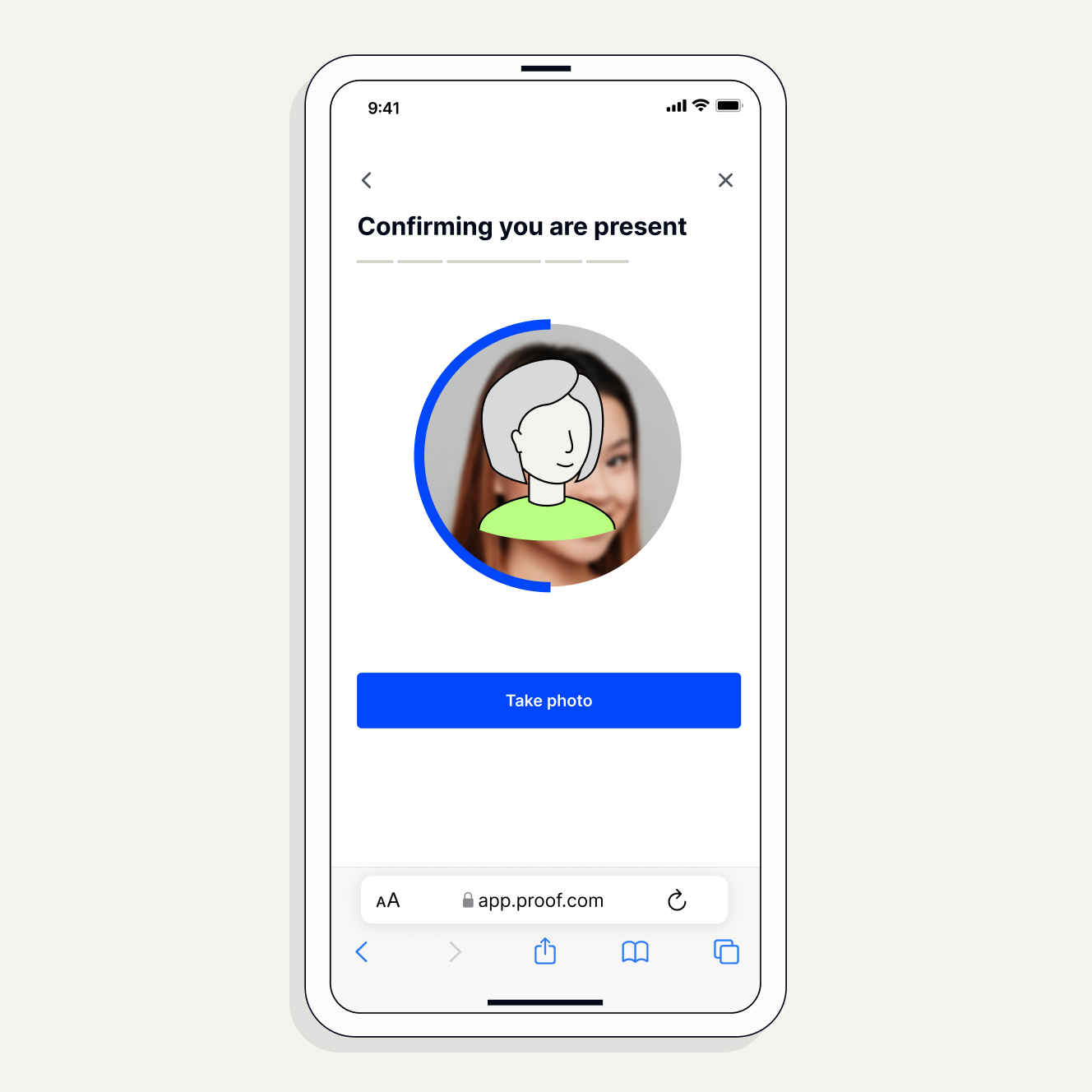

4. Your customer verifies their presence

Your customer will take a selfie to verify that they are present. This step detects if a signer is holding up an ‘electronic replica’ of a photo during this automated check. The platform also verifies that the selfie matches the government-issued ID.

5. If necessary, your customer connects with a trusted referee on a video call

If the Proof platform uncovers any identity inconsistencies or your signer does not have adequate identification, we’ll step up the verification process to a trusted referee. Trusted referees are notaries who are trained in fraud detection. They’re available 24/7.

6. Your customer eSigns the document

The signer creates their electronic signature and eSigns the document.

7. Access and download completed document

You and your customer will have immediate access to the completed documents. You both can return to the Proof platform at any time to access past documents and upload new ones.

Proof of identity use cases

Get identity evidence on every transaction

The ROI of identity-assured transactions

Customize identity proofing checks to the assurance level you need

With Proof, you can build custom identity verification processes to support all your business’ use cases.

Reduce fraud

Proof’s identity proofing tools in remote online notarization complete 25+ verification checks in less than five seconds. Have confidence that your signer is who they say they are.

Meet the IAL2 identity proofing standard

Proof is the first company approved by the Kantara Initiative, that connects an electronic signature to an IAL2 identity all on one platform.

Reduce your fraud risk with identity verification

Have trust in every signature